Complimentary Download

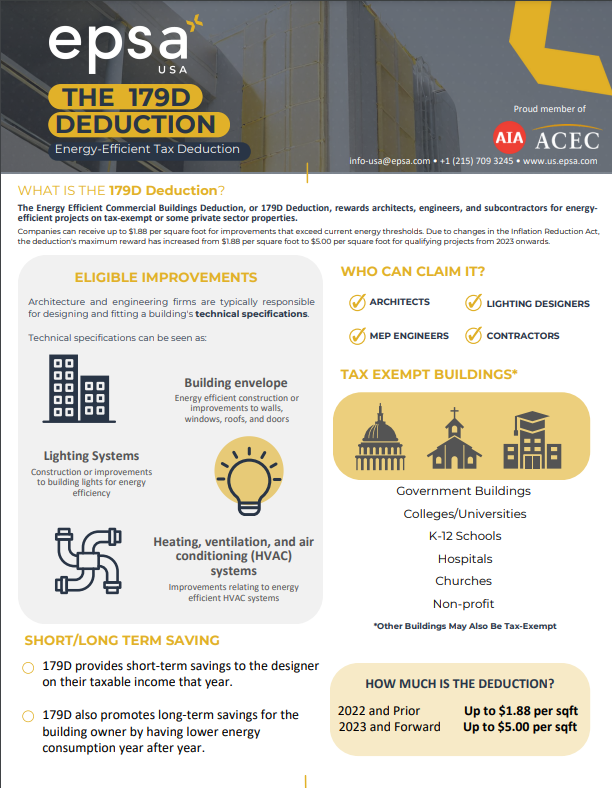

What is the 179D Deduction?

The Energy Efficient Commercial Buildings Deduction, or 179D Deduction, rewards architects, engineers, and subcontractors for energy efficient projects on tax-exempt or some private sector properties.